estate tax changes in reconciliation bill

Gift in 2021 of 11000000. At the same time the bill would raise taxes substantially.

Tax Take Time Keeps On Slippin Slippin Slippin Into The Future Miller Chevalier

The original bill proposed to cut the exemption amount in half.

. 2021 Reconciliation Bill. 107-16 among other tax cuts provided for a gradual reduction and elimination of the estate tax. The top income tax rate for long-term capital gains would increase from 20 to 25.

Growth and Tax Relief Reconciliation Act of 2001 EGTRRA. As negotiations over spending and taxes in a potential budget reconciliation bill tentatively the Build Back Better Act are ongoing in Congress Democrats on the House Ways and Means Committee on Sept. If the bill becomes law.

It depends what day it is. This means the current inflation-adjusted exemption of 11700000 per person would be reduced to approximately 6000000. 13 released the draft text of their proposed tax-raising provisions which was the subject of a.

And even though the legislation is still subject to change there are proposed. Leaves the rules on grantor trusts and GRATs unchanged retaining the full value of these estate planning techniques. The tax bill dropped Monday by Democrats on the House Ways Means Committee includes an array of changes to estate assets trusts corporate taxes and business deductions.

Is on at least some changes to tax law that will have widespread impact on many Americans. Revised Build Back Better Bill Excludes Major Estate Tax Proposals In late October the House Rules Committee released a revised version of the proposed Build Back Better Act Reconciliation Bill. Estate is 16000000 Exemption 1000000.

Estate is 10000000 Exemption 0. On November 1 2021 the House Rules Committee reported out the Build Back Better Act Reconciliation Bill which leaves out most. Uncertainty makes tax and estate planning more challenging.

Estate is 21000000 Exemption 5300000. The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011. Estate and gift tax exemption.

Death in 2022. The Infrastructure Bill passed the House and President Biden signed it into law on November 15th yet Congress continues to debate the repayment details of the Budget Reconciliation Bills provisions. All major provisions of the House Ways Means Committees budget reconciliation tax bill would cut 2022 taxes on average for households making 200000 or less.

Congressional Democrats are still wrangling among themselves over what provisions or tax law changes are or arent in the formerly 35 trillion Build Back Better bill. Here are some changes the budget reconciliation tax law would bring about. What tax hikes are in the social policy and climate change bill that Democrats are trying to pass by year-end.

The top marginal rate income tax rate would increase from 37 to 396 for individuals trusts and estates. In 2010 the estate tax was eliminated. This preliminary analysis is still available here.

House of Representatives introduced a reconciliation bill that includes significant changes to estate gift and generation-skipping tax laws. Under EGTRRA the estate tax exemption rose from 675000 in 2001 to 35 million in 2009 and the rate fell from 55 to 45. Potential Tax Changes With the 2022 Fiscal Year Federal Budget deadline of October 1 st rapidly approaching House Democrats presented a preliminary tax proposal targeting high earners wealthy estates and corporations to fund Bidens proposed 35 trillion infrastructure spending package.

2 days agoAdditionally the bill modifies the estate tax in various ways including by reducing the number of brackets to three increasing the tax. Estate Tax 15700000 x 40 6280000. The Ways Means Reconciliation Bill Would Raise Taxes On High Income Households Cut Taxes On Average For Nearly Everyone Else.

Five Tax Implications of the Budget Reconciliation Bill for Retirement Savers. Estate Tax 10000000 X 40 4000000. Does not reduce the gift estate and generation-skipping transfer taxes exemption which is set to increase to 1206 million on January 1 2022.

USA October 1 2021. The revised bill. Estate planning changes dropped from US budget reconciliation Bill.

The draft legislation was expected to be included in a larger budget reconciliation bill but as of. Estate Tax 15000000 X 40 6000000. Most of the major proposals that would create substantial changes in the estate planning arena were not included.

The amended change would raise the cap to 80000 from 2021-2030 and revert back to 10000 for 2031. Thursday 04 November 2021. The estate tax exemption would be reduced as of January 1 2022 from its current 117 million to 5 million adjusted for inflation.

The many changes floated since the presidential and congressional elections of 2020 would have reduced the. At this writing President Biden is in Rome for the G20 Summit to be followed by the UN Climate Change Summit in Glasgow. On September 27 the US.

The latest draft of the US Congress budget reconciliation Bill omits most of the previously proposed tax changes that would have affected US estate planning. Major tax changes in draft reconciliation bill. As the budget reconciliation bill goes up for a final Senate vote real estate partnerships should be evaluating how to adjust to the potential tax changes.

This analysis was updated to contain the November 4th amended changes to the cap on the state and local tax SALT deduction. The latest version a. Gift in 2021 of 0.

Instead it contains three primary changes affecting estate and gift taxes. The expiration of the current laws estate tax exemption 24 million for married taxpayers would be accelerated by the.

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Explore Our Sample Of Direct Deposit Payroll Authorization Form For Free Payroll Workforce Management Business Finance

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Could We Reform The Estate Tax Tax Policy Center

Everything In The House Democrats Budget Bill The New York Times

Excel Savings Calculator Excel Savings Spreadsheet Excel Etsy Australia Savings Calculator Savings Tracker Emergency Fund

Everything In The House Democrats Budget Bill The New York Times

Retirement Death Tax Bank Reporting Provisions Stripped From Reconciliation Bill For Now

What Happened To The Expected Year End Estate Tax Changes

Fillable Form 1040 Individual Income Tax Return Income Tax Income Tax Return Tax Return

100 Smart Ideas For Saving More Money Saving Money Money Saving Strategies Save Money On Groceries

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

Gst Registration Services Provider In New Delhi Important Facts Certificates Online Reconciliation

Will It Or Wont It Newest Reconciliation Bill Lacks Major Estate Tax Law Changes

How Could We Reform The Estate Tax Tax Policy Center

Bank Reconciliation Spreadsheet Microsoft Excel Microsoft Excel Reconciliation Bank Statement

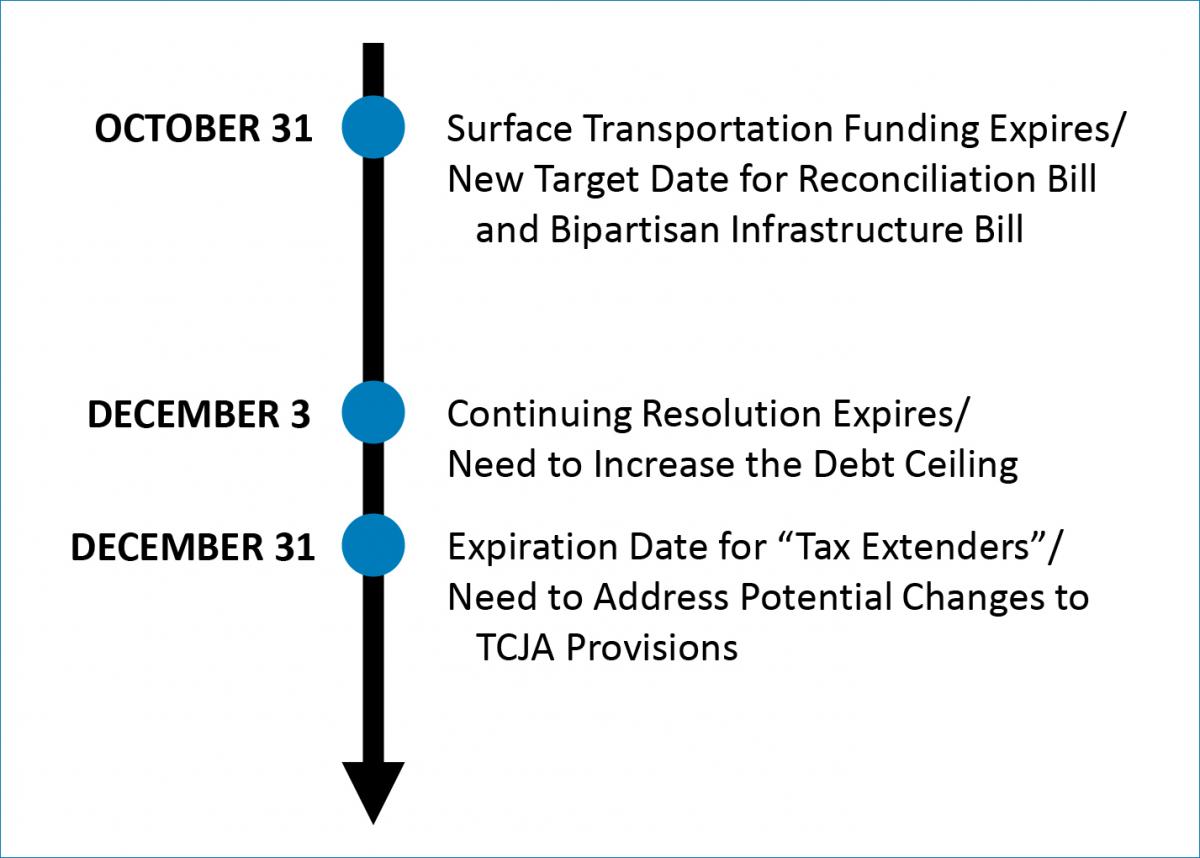

Will Congress Reshape The Tax Landscape Bernstein

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation