multistate tax commission member states

86-272 income tax immunity. Its purpose is to create uniformity amongst state tax laws and foster fair equalization of tax base revenues.

.jpg.aspx)

Multistate Tax Commission News

Any inconsistencies are attributable to the original source.

. 114-74With extended 2018 partnership returns timely filed by Sept. In 1986 the MTC adopted the Statement of Information Concerning Practices of Multistate Tax Commission and Signatory States Under Public Law 86-272 which sets forth the MTC signatory states interpretation of those in-state activities that are conducted by or on behalf of a corporation and fall within or outside the protection of PL. Commission members acting together attempt to promote.

Multistate Tax Commission 444 North Capitol Street NW Suite 425 Washington DC 20001 Phone. It is the executive agency charged with administering the Multistate Tax Compact 1967. Multistate Tax Commission About us accessed October 19 2011.

Multistate Tax Commission means. This text is quoted verbatim from the original source. The Multistate Tax Commission has filed an amicus brief with the Oregon Tax Court in Santa Fe Natural Tobacco Co.

As of 2021 the District of Columbia and all 50 states except for Nevada are members in some capacity. 1 2018 for many partnerships enacted as part of the Bipartisan Budget Act of 2015 PL. 2 As of 2021 the District of Columbia and all 50 states except for Nevada are members in some capacity.

1 It is the executive agency charged with administering the Multistate Tax Compact 1967. 3 Commission members acting together attempt to promote uniformity in state tax laws. Intergovernmental state agency whose mission is to promote uniform and consistent tax policy and administration among the states.

S are states that support the purposes of the Multistate Tax Compact through regular participation in and financial support for the general activities of the Commission. The Multistate Tax Commission is an intergovernmental tax cooperative agency that was born from the multistate tax compact law. The Multistate Tax Commission works with.

A group appointed by the member states that writes rules and regulations interpreting the Uniform Division of Income for Tax Purposes Act. The Multistate Tax Commission MTC is an interstate instrumentality located in the United States. Related Entries in the American Tax Encyclopedia.

These states join in shaping and supporting the Commissions efforts to preserve state taxing authority and improve state tax policy and administration. Get a brief overview of Multistate Tax and see our current team of knowledgeable and dedicated employees. Rest easy knowing your taxes will be properly handled every single year with the help from the experienced team at Multistate Tax Inc.

Establishes a commission whose purposes are 1 to facilitate proper determination of state and local tax liability of multistate taxpayers 2 to promote uniformity and compatibility in significant components of tax systems 3 to facilitate taxpayer convenience and compliance 4 seeks to avoid duplicate. MEMBERS OF BBB NATP. It is the Multistate Tax Commission MTC or Commission a US.

Important changes in the federal partnership audit rules began to apply for tax years beginning Jan. Officers. 444 North Capitol Street NW Suite 425.

This allows multistate tax payers to properly apportion their tax liabilities in a manner that does not. The Multistate Tax Commission MTC is an interstate instrumentality located in the United States. This case considers whether in-state activities conducted by an independent contractor pursuant to a contract with an out-of-state seller negates the sellers PL.

The Multistate Tax Commission a multistate agency made up of state taxing authorities whose aim is to encourage uniform state tax laws has adopted after several months consideration a uniformity recommendation ie a model statute that requires partnerships to withhold income tax at the states highest tax rate on each nonresident partners share of the. For over 50 years the MTC has. The Commission has developed a Uniform Sales Use Tax Resale Certificate that 36 States have indicated can be used as a resale certificate.

The Multistate Tax Commission MTC is set to revamp its transfer pricing collaboration and enforcement initiatives following the first public meeting of its State Intercompany Transactions Advisory Service SITAS Committee in over four years. 15 2019 the IRS is expected to begin to conduct audits using the new partnership audit regime in 2020. It was established in 1967 as part of the Multistate Tax Compact an agreement formalized into law by many states in order to create more stability for interstate commerce.

The Certificate itself contains instructions on its use lists the States that have indicated to the Commission that a properly filled out. The Procedures of Multistate Voluntary Disclosure govern the NNP staff and member states during the process. Director National Nexus Program.

The Multistate Tax Commission is an intergovernmental state tax agency located at 444 North Capitol Street NW in Washington DC. As of 2021 the District of Columbia and all 50 states except for Nevada are members in some capacity. This multijurisdiction form has been updated as of June 21 2022.

One of the most influential sources of policymaking in the state tax law arena is not a state legislature court or executive agency. Bolton overviewed the responses of 24-member states to an informal SITAS. It is the executive agency charged with administering the Multistate Tax Compact 1967.

2 As of 2011 47 states are members of the Commission in some capacity. For further information please contact. The Multistate Tax Commission or MTC is a United States intergovernmental state tax agency 1 created by the Multistate Tax Compact in 1967.

The Multistate Tax Commission MTC is an interstate instrumentality located in the United States. Multistate Tax Commission Member States accessed February 17 2021.

Multistate Tax Commission News

Multistate Tax Commission News

Washington State Sales And Use Tax

Multistate Tax Commission Home

Implementing Recent Mtc Guidelines Pl 86 272 And The Finnigan Method Cpe Taxops

Multistate Tax Commission Home

Chris Barber Counsel Multistate Tax Commission Linkedin

State Tax Law Changes For The First Quarter Of 2022 Hayashi Wayland

New York Takes Steps To Follow Revised Mtc P L 86 272 Guidance

Multistate Tax Commission Home

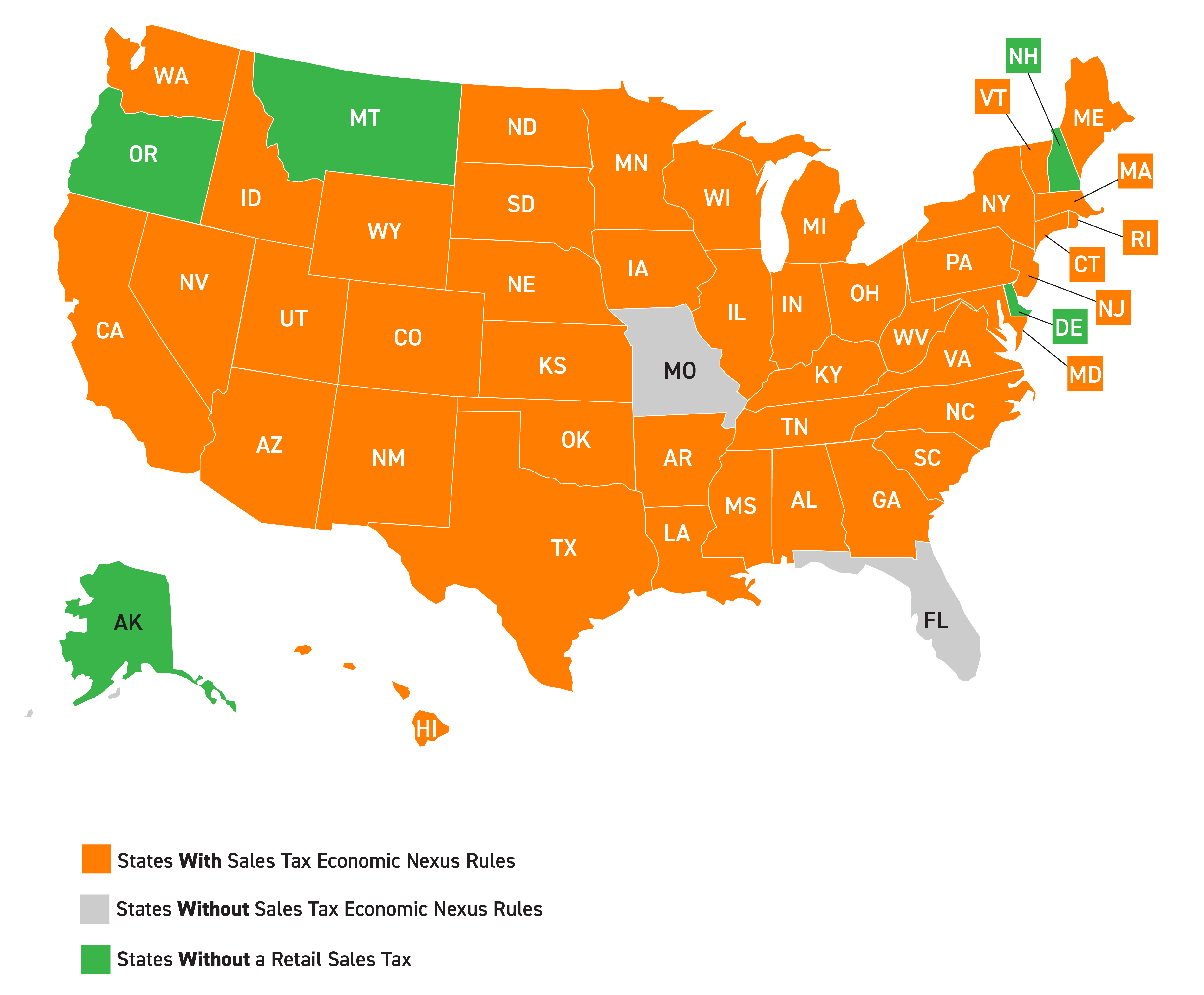

Forty Two States Have Now Adopted Marketplace Sales Tax Collection Laws Multistate

To Obtain A Copy Of The Request For Information Rfi Multistate Tax